// Interview with Frank Wulf

An interview with Frank Wulf, Global Head of Aviation NORD/LB, about the development of wide-body aircraft and NORD/LB's range of services for aviation customers around the world.

Mr Wulf, it looks like wide body aircrafts are currently going through a heavy downswing. How do you expect the market for long haul to develop over the next years?

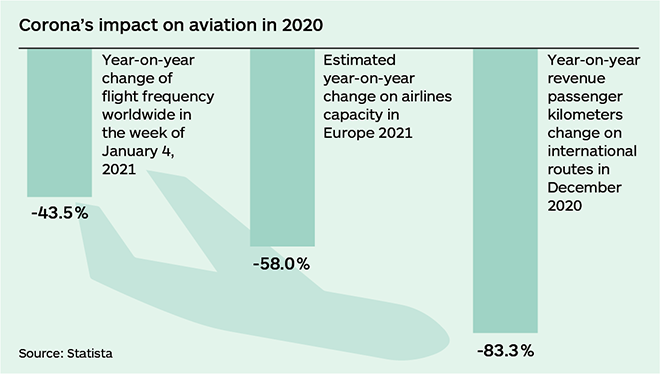

That’s true, the corona-related global travel restrictions have had a particularly negative impact on passenger wide bodies. Referring to the latest data of NORD/LB Research the current wide body storage rate is approx. 37 % whilst the narrow body recovery is progressing relatively well, which is evidenced by a much more moderate storage rate of 17 %.

How quick the recovery of the long-haul market will be very much depends on the progress being made on containing COVID-19 and with that the lifting of the current travel restrictions. Based on our latest research we expect long haul passenger numbers to reach pre-crisis levels by late 2024 or early 2025. However, since airlines have a tendency of stimulating demand by increasing supply we expect the number of in-service wide bodies to reach 2019 levels already during the course of 2023.

Corona led to a dramatic increase in international cargo flights. As a result, many airlines converted a number of passenger wide body airplanes into makeshift freighters. At the same time many carriers retired their largest passenger wide bodies. Which structure do you see for the wide body fleets of the future?

Cargo Airlines are clearly the biggest winner of the pandemic. With more than a third of the passenger wide body fleet being parked there is substantially less belly capacity available to move air freight than in the past. With a substantial number of the largest wide bodies (A380, B747-8I, B777-300ER) being permanently removed from service I expect cargo airlines to do well for many years to come.

With regard to the future composition of the global wide body fleet we expect to see a clear shift from the a.m. (very) large wide body types with a capacity of well above 400 seats to the more versatile large-to-medium wide bodies (B777-8/-9, A350-900/-1000 and B787-9/-10). One type clearly struggling at the moment is the B787-8, which is much more of a niche aircraft than its bigger sibling, the B787-9. As such, it’s full recovery might be quite a challenge. However, the B787-8 certainly has its merits on long routes with passenger demand too small to fill larger wide bodies and yet too big for the A321LRX.

How are the manufacturers of aircraft currently reacting to the wide body crisis [preparing for the future with fewer wide body aircrafts]? And what role does sustainability play here in fleet creation?

As mentioned above, NORD/LB expects to see the global wide body fleet to reach pre-crisis levels during the course of 2023. The OEMs (original equipment manufacturers) have met the wave of cancellations and relatively few new orders over the last 20 months by significantly cutting their wide body production by – depending on the type – 40 to 65 %, which should also help to ease the pressure on the currently parked wide bodies.

The ever-growing focus on making aviation a more sustainable industry will clearly have a significant impact on the future fleet composition. Most airlines and lessors have subscribed to become carbon-neutral by 2045 or 2050 latest. Hand in hand with that goes the firm commitment of gradually increasing the percentage of aircraft that meet the highest carbon and noise emission standards. As a result, the entire fleet (not only wide bodies) will become much younger, much more fuel efficient, cleaner and quieter over time. Whilst I don’t expect to see too significant changes to the propulsion systems of the larger aircrafts we are likely to see new engine concepts for smaller aircraft with a capacity of up to 50 seats.

What services do you offer and how does NORD/LB support its clients in aviation around the world?

NORD/LB has a long history of almost 40 years in aviation finance. Our experienced teams in Hannover, New York and Singapore have tremendous expertise in structuring complex and innovative taylor-made financing solutions, which meet the highest expectations of our airline and aircraft leasing clients. Our products range from secured direct loans, finance and operating leases to pre-delivery payment (PDP) financing, as well as large portfolio and warehouse facilities. We have profound asset knowledge and are also prepared to take residual risk positions.

NORD/LB is 100 % committed to supporting our airline and leasing clients in the transition process of making aviation a much more efficient and environmentally friendlier industry.

// Contact